If you don’t pay your credit card bills on time, you will end up paying late fees and increased interest charges, damaging your credit score. With a modern solution called Cred, Kunal Shah has come to save you from this hassle.

Cred is an Indian fintech company that provides customers with the convenience of making multiple credit card bill payments on time. In return, Cred gives rewards and perks to its customers.

Credit is an Indian fintech company that allows customers to make multiple credit card bill payments on time. In return, Cred rewards its customers.

In this guide, you’ll Know:

Startup Story Of CRED

The goal was simple. This was to create a platform where financial life could be made better and orderly. Kunal Shah wanted to give more privileges and benefits to people with good credit scores. And so, it was important to make the flywheel effect for more people to improve their credit scores.

From startups to the government, everyone has focused on the masses. The founders of the company specifically wanted to focus on those people, responsible citizens who pay taxes on time. They felt that no one had solved their problems before.

Hence, CRED was established primarily to solve the problems of the taxpayers and reward them with lucrative rewards in return.

Who is the CRED Target Customers?

CRED aims to target a significant proportion of wealthy, affluent and trusted customers who own and use credit cards. This creates a secure community of loyal and reliable individuals which ultimately creates mechanisms for them to add and expand to many more possibilities in the future.

The company targets customers who have a good credit score, I mean above 750. If those who do not have a good credit score, they have to wait and give suggestions to improve their credit score.

CRED’s Value Proposition

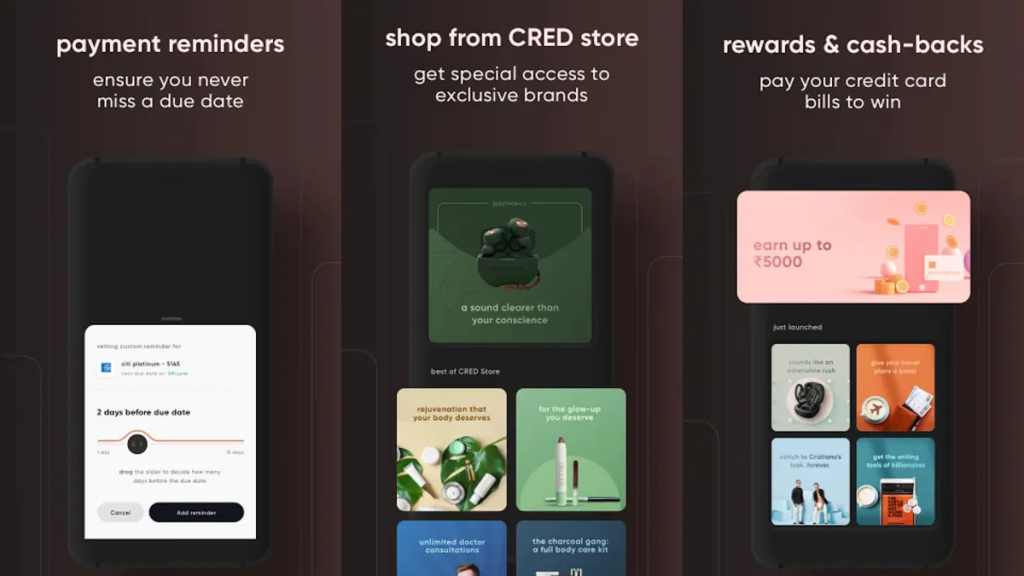

Popular for its superior user experience, CRED’s business model stands out by providing the following values to its customers:

- It is an all-in-one application to pay credit card bills, rent and other bills in just five taps. It reduces the headache of handling multiple credit cards by making the process extremely simple, easy and convenient.

- CRED offers users instant credit lines and offers lenders the convenience of P2P lending at an interest rate of 9%, which is typically higher than savings accounts and deposits.

- It records loan caps, analyzes users’ hidden costs and total expenses and tracks due dates and sends them timely reminders to make payments.

- If users pay on time, it rewards them with CRED coins which they can redeem on the ‘Discover’ platform to avail of discounts on multiple products offered by CRED partners.

- Users can also calculate their credit score for free and use CREDs to maintain a good credit profile and make sound financial decisions.

Most importantly, CRED is a niche community of highly-credible creditworthy individuals. It works along the lines of loyal customers, where people pay together and can play together. This creates a social network with a tremendous scope of connecting people to a realm of other possibilities.

Business Model of CRED

Cred rewards customers for making payments on time. Cred tie-up with brands and businesses to provide offers on accessories for customers. These offers and schemes attract customers to use the cred app for their daily payments.

The 3 things to consider in CRED’s business model – Customers who pay credit card bills, The CRED app, and the Business that provides offers on the app.

1. CRED’s Customers

Most credit card users pay their credit card bills using a payment app or by logging into their bank account directly. Using the Credits app they do the same thing but more profitably. As more people use CRED to earn profits, they share those benefits more widely.

2. CRED App

The app allows users to view all available offers upon signing up and paying their credit card bills. As you continue to pay bills, you collect CRED Coins which you can redeem for rewards.

3. Offers on The App

CRED must bring businesses on board and build alliances with them. The CRED app gives visibility to small and large businesses alike as all types of buyers use it. As a result, brands get more sales and CRED gets more users.

To access CRED programs, a credit score of over 750 must be obtained. The application allows users to share specific data such as credit card numbers and email access to track users’ expenses and dues, credit scores, and how they invest their money. CRED rewards its users with CRED coins for bill payments which can be later redeemed with available offers. To clarify, CRED provides a primary incentive to make instant bill payments. CRED partners with various businesses to make the offers more attractive to the users. In turn, companies come into contact with buyers from all walks of life.

How does CRED make money?

CRED earns money from listing fees businesses pay to display their products and offers on its app. Moreover, financial institutions have access to the financial data collected from users to tailor their offers accordingly.

- Through CRED, you can access products and offers from businesses that have paid to access Discover. Among the offers are fashion retailers, spas, Amazon gift cards, and more. These offers give their users a variety of rewards to pick from. As a result, it attracts users’ attention. CRED receives a fee from the business every time a user redeems CRED coins from the app to pick an offer.

- CRED collects your financial data as you use the app and continue to pay your bills to offer you better offers in the future. The second source of revenue and institutions are always searching for the most reliable customers to use their credit cards, loans, and other products. To gain access to this data, banks and credit card companies pay CRED.

CRED has no single best source of revenue. CRED has a varied product/service span – Rentpay, CRED Stash, Store, Credit Card Payments, and CRED Pay.

CRED Pay:

This feature was built in partnership with Razorpay and Visa. It provides brands with a D2C channel by offering them an instant payment experience on their platforms.

CRED RentPay:

RentPay allows tenants to pay monthly rent using a credit card, which directly transfers the amount to the landlord’s bank account. The main advantage here is that the app helps users get an interest-free credit period on rent and also lets them earn reward points on their credit cards. Depending on the user’s credit card network, it will charge users a transaction fee of 1% – 1.5%.

CRED Store:

The store is a member-exclusive selection of products and experiences at exceptional prices. You receive CRED coins every time you pay your credit card bills on CRED. They can use these coins to win exclusive rewards or get special access to curated products and experiences.

CRED Stash:

It’s a digital lending platform that makes a personal credit line available online to users. Here the Registration/ Subscription Charges is Nil; however, the bank charges interest on money borrowed, which is displayed on the app while availing the loan.

In Conclusion

CRED has a very innovative and creative way of marketing itself. It delivers cakes to its users’ offices so that other people get to know about it and create a buzz effect. This strategy helps the company initiate a viral loop, generate more customers, and create a ‘brag-worthy proposition.’

As customers continue to pay their bills and use the platform, the company will have a lot of their financial data, which they can monetize in the future. They can use the data to enhance and personalize users’ app experience even if they don’t sell it to some financial institution or bank for privacy reasons.

It emphasizes building a gated community and implementing the idea behind the startup before expanding it further and becoming profit-oriented. Another important takeaway is that founder Kunal Shah focuses more on how the demand for services or products should determine the idea behind a startup and have a unique and brag-worthy proposition.

Related: LinkedIn Business Model | How LinkedIn Makes Money?